Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

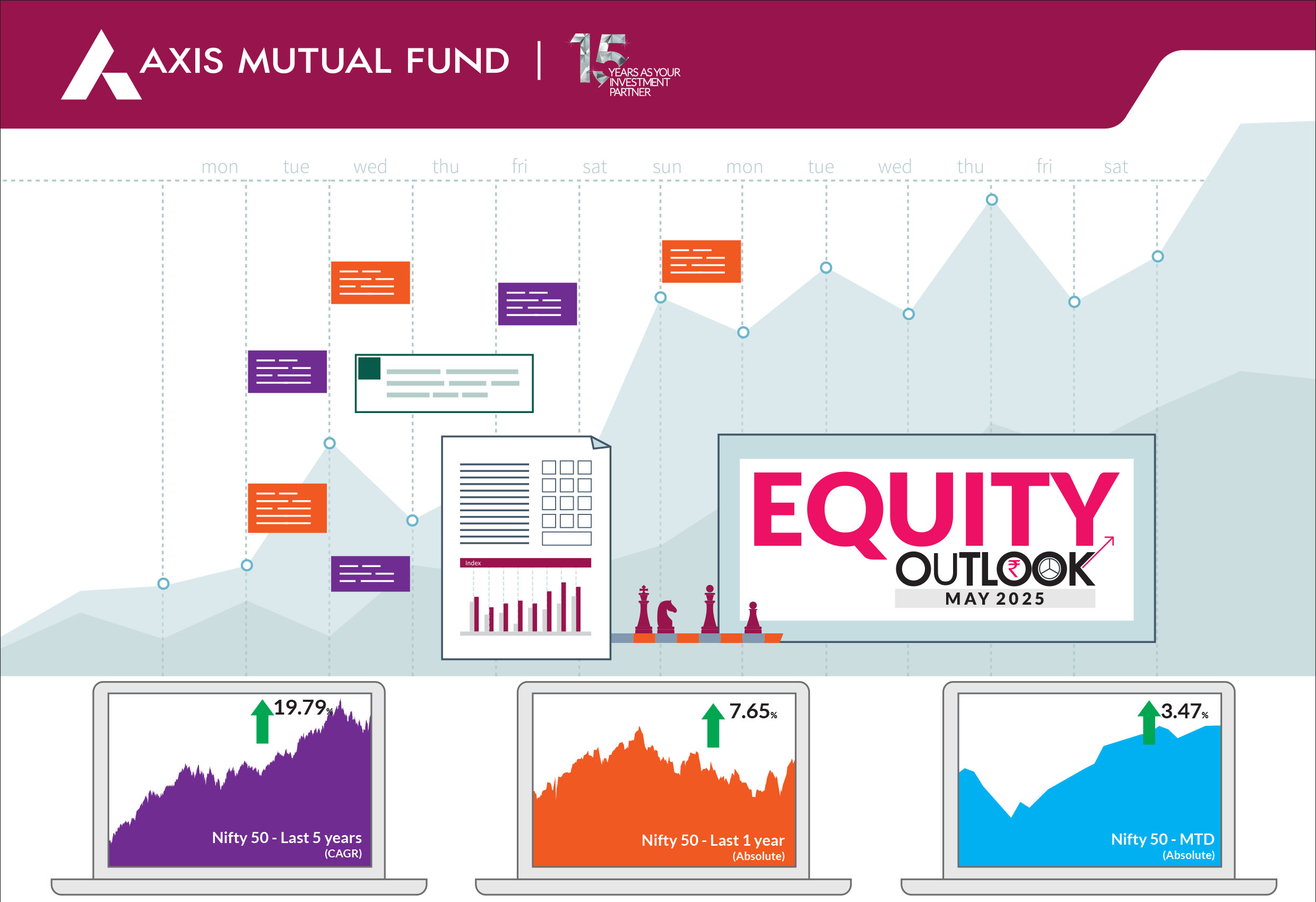

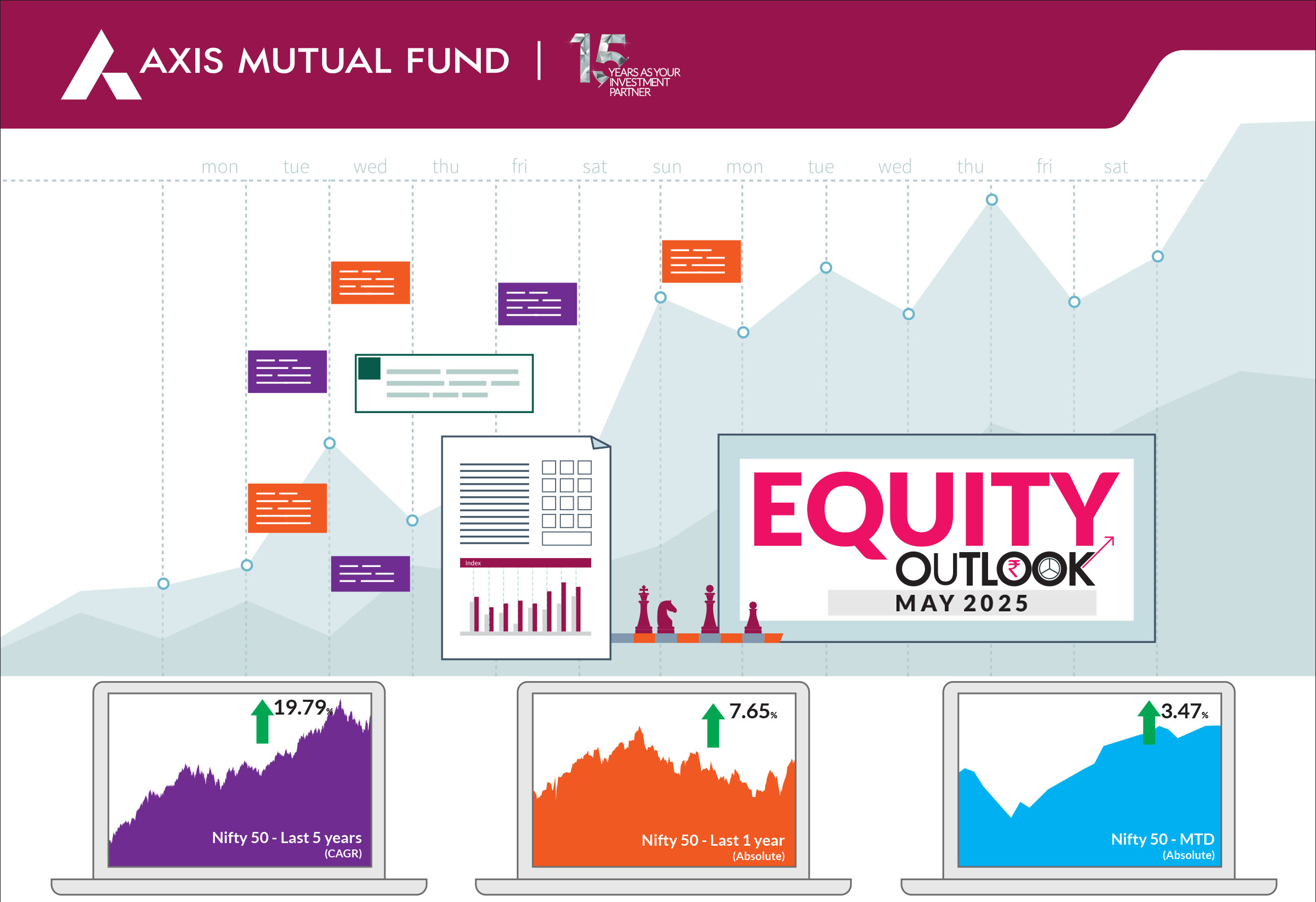

April was marked by significant volatility, with markets experiencing both substantial gains and sharp declines. Reciprocal tariffs and their impact on countries remained the global theme causing investors and markets to shift to safer havens like gold. On April 2, the US administration levied reciprocal tariffs on all countries with tariffs ranging from 10-49% across countries. However, markets across the globe including India improved as sentiment turned optimistic following the pause on tariffs for 90 days. Indian equities ended higher for the second consecutive month. The BSE Sensex and Nifty 50 closed 3.7% and 3.5% higher, while the NSE Midcap 100 advanced by 4.8% and the NSE Smallcap 100 by 2.2%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in April but turned net buyers to a small extent, buying US$0.5 bn. In contrast, DIIs bought equities worth US$ 3.1bn. The rupee appreciated approx. 1% in April vis a vis the US dollar This level is rupee's highest in 2025. The US dollar lost 3% in April and was weaker against most currencies and around 5% weaker so far in 2025. |

|

The midcap valuation premium over Nifty (proxy for large caps) has corrected sharply from the peak of 68% in Dec'24 to 39% currently but remains high vs the 10Y average of 18%. Small caps premium, on the other hand, have risen significantly in the past month, and at 19% still remains high. On the earnings front, April was the eighth consecutive month of downward revisions to NSE 200 EPS estimates for FY26E. However, the pace of cuts has slowed from the past two quarters. In NSE200, midcaps saw higher cuts to FY26E EPS vs large caps in April, and the cuts were primarily in discretionary, IT, and industrials, while real estate and utilities saw upgrades. Within NSE 500, the earnings misses have been led by IT, FMCG and financial services (NBFCs and insurance). Given the current state of the markets, we reiterate the fact that markets are not unidirectional, making it crucial to stay invested to capitalize on any declines. While markets may remain volatile in the near term, investors should be mindful that long-term wealth growth is best achieved through an asset allocation approach and diversified investments across various types of funds. While from the highs of 2024, indices fell 16-25%, they have recovered half of the losses so far. On the macroeconomic front, brent crude is lower, headline inflation is below central bank's 4% target and we may see further interest rate cuts. Domestic liquidity has improved and is in surplus following injections by the central bank through various tools; however, domestic indicators do suggest moderating demand. This coupled with the global uncertainty will lead to moderation in growth in India. In the current scenario, we believe that earnings growth is unlikely to support valuation expansion in the near term. In terms of sectors, we are overweight financials, particularly NBFCs and pharma, we remain overweight the consumer discretionary segment through retailers, hotels, travel and tourism and have reduced our overweight in automobiles and remain underweight information t ech nol og y. R en ewabl e ca p ex , ma n u factu re r s and power transmission/distribution companies, defense are the other themes we favour. Notwithstanding expectations of lower growth in the short to medium term, India's long term growth story is supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the re-leveraging of corporate balance sheets, and a structural increase in discretionary consumption. |

Source: Bloomberg, Axis MF Research.